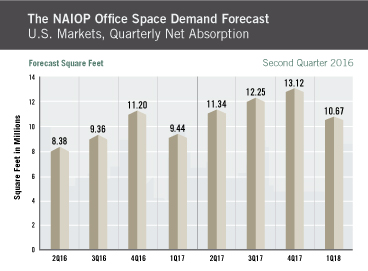

by Brianna Crandall — July 22, 2016 — The national office market is forecast to absorb approximately 34.6 million square feet of space in 2016, down from 62.1 million square feet in 2015, as economic growth flattens in the United States, according to commercial real estate development association NAIOP’s Office Space Demand Forecast, Second Quarter 2016, written by Dr. Hany Guirguis, Manhattan College, and Dr. Joshua Harris, University of Central Florida.

Gross domestic product (GDP) growth, which slowed to 0.5% in the first quarter of 2016, is forecast by the model to remain low, near 1%-2% annualized growth, with the lower boundary of the GDP forecast dipping into slightly negative territory. The current forecast projects net absorption of office space to regain some strength in 2017, totaling approximately 46.2 million square feet. However, this figure could change, depending on how the economy fares throughout the rest of 2016.

Overall, the U.S. economic condition is more tenuous in mid-2016 than it has been in recent years, according to the report. Low energy prices and a declining global economic outlook — due, in part, to European debt crises and a slowing Chinese economy — have finally had a measurable impact on the domestic situation.

Overall, the U.S. economic condition is more tenuous in mid-2016 than it has been in recent years, according to the report. Low energy prices and a declining global economic outlook — due, in part, to European debt crises and a slowing Chinese economy — have finally had a measurable impact on the domestic situation.

The biggest drag on the forecast comes from lower GDP expectations going forward and falling rates of nonresidential private fixed investment, which measures the willingness of private businesses to expand their productive capacity. The second most significant driver of the forecast relates to declining corporate profits, which have been falling since Q4 2015, a reversal of a trend that bears watching and is a cause for concern, especially for the office sector, notes the report.

“Employment, both overall and in the office-using sectors, had maintained fairly steady growth until the most recent reading for April 2016, which registered only 160,000 net new jobs. This was well below the 200,000 jobs-per month threshold considered the minimum necessary for sustained economic growth,” says Harris. “We expect the overall declines in macroeconomic output to continue to result in lower employment gains for the rest of 2016.

“The office-using sectors are forecast by our model to decline in their rate of growth as well, but this has yet to register in the available data. We forecast that office-using employment gains will soften in 2016 as those sectors feel the impact of less macroeconomic activity. If the office sector manages to maintain its level of growth despite the economic headwinds, office absorption will likely be closer to the high end of the forecast range, which is 35.1 million square feet for 2016 and 49.1 million square feet for 2017.

“Indicators from the Institute for Supply Management Non-Manufacturing indices are not yet showing a decline, but we believe the falloff will come.”

Finally, it is important to note that the current readings and forecasts for economic indicators point to an economy approaching a point of inflection, one that is moving from expansion to contraction, say the researchers. This is the most difficult environment in which to make forecasts, as these changes can occur more or less rapidly than statistical analyses can predict.

“Overall, we are not yet forecasting a recession or significant downturn, just a flattening that should cause office demand to level off,” Guirguis and Harris conclude. “Further, since the economy has been growing slowly for the past several years, it is likely that there is not enough ‘overheating’ for a recession. If one were to occur, chances are it would not last very long or be very deep. Office markets do not yet appear to be overbuilt nationwide. Therefore we do not expect significant negative impacts to the office property sector.”

Still, any reduction in net demand for office space is likely to soften rental rates and, thus, impact the bottom line of office investors and developers, points out NAIOP, although this could be welcome news for office occupiers.

A summary and the complete NAIOP Office Space Demand Forecast, Second Quarter 2016 report are available online.