by Brianna Crandall — January 6, 2017 — Relentless cost-cutting by businesses — and banks in particular — is expected to see the outsourcing sector grow by 6% annually for the next six years, according to an annual report from global property firm Cushman & Wakefield.

This year’s Where in the World assessment of the outsourcing sector suggests the trend of service industries to repatriate call centers and other shared service centers (SSC) to improve customer satisfaction is relatively small to the continued drive to offshore back- and mid-office processes.

This is because the wage gap between advanced economies and the emerging locations where many outsourced jobs are based is not expected to narrow sufficiently for many years to come, according to the report.

One of the report’s authors, Neil McLocklin, co-head of Strategic Consulting (EMEA) for Cushman & Wakefield, said:

Central Europe has seen rapid growth in outsourced jobs from Western Europe since the Millennium. Even assuming high levels of salary growth of 4%-5% annually, compared to just 1%-2% in Western Europe, it will take 15 to 20 years for the salary gap to narrow from its current ratio of about 1:3 to around half.

In addition, more established outsourcing locations such as Poland face other pressures that could impact future outsourcing sector growth. These include:

- Increased competition from new lower-cost locations in neighboring countries such as Romania;

- The rapid growth of advanced of robotic process automation and cognitive computing;

- Increased costs in combating the growing technological threat by up-skilling existing workforces to provide more than basic language and numeracy skills; and

- Challenging demographic trends and migration of skilled labor especially from secondary cities to western Europe.

From a global perspective, India has retained its position as the world’s leading outsourcing market with 56% global market share, with the Philippines in second place with 15% — an industry that delivered 7% of the country’s gross domestic product (GDP) in 2015 compared to just 0.08% in 2000.

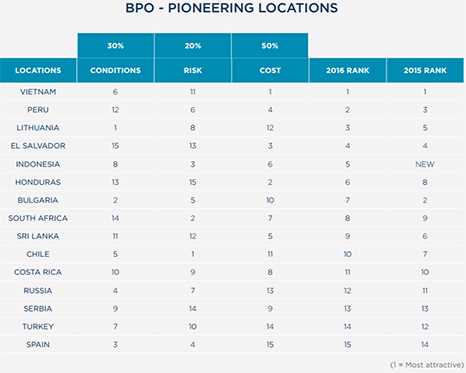

The Where in the World report ranks nations according to their attractiveness for business process outsourcing (BPO), taking into account factors including cost, quality of service and their political and economic stability. It separates these markets into two categories: “Mature” and “Pioneering.”

The report’s fellow author, Tamas Polster, co-head of Strategic Consulting (EMEA), added:

In pioneering outsourcing markets, Vietnam retains its global number one spot from last year. Europe’s top performer is Lithuania, up to third position from its fifth placing in 2015. Although outsourcing is facing pressures from rapid advances in automation, it will remain a growth industry for many years to come. It is, however, a business service that needs to be chosen by its customers with great care.

Pricing is, of course, a very important consideration. But the quality of the service is paramount to firms keen to ensure customer retention — a reliable and effective service. Established BPO & SSC locations have in recent years significantly raised their service level sophistication, relying on more automation and themselves near shoring their lower value processes to emerging markets to maintain their competitive edge.

To view or download the full report, Where in the World? Business Process Outsourcing and Shared Service Location Index 2016, visit the Cushman & Wakefield Web site.