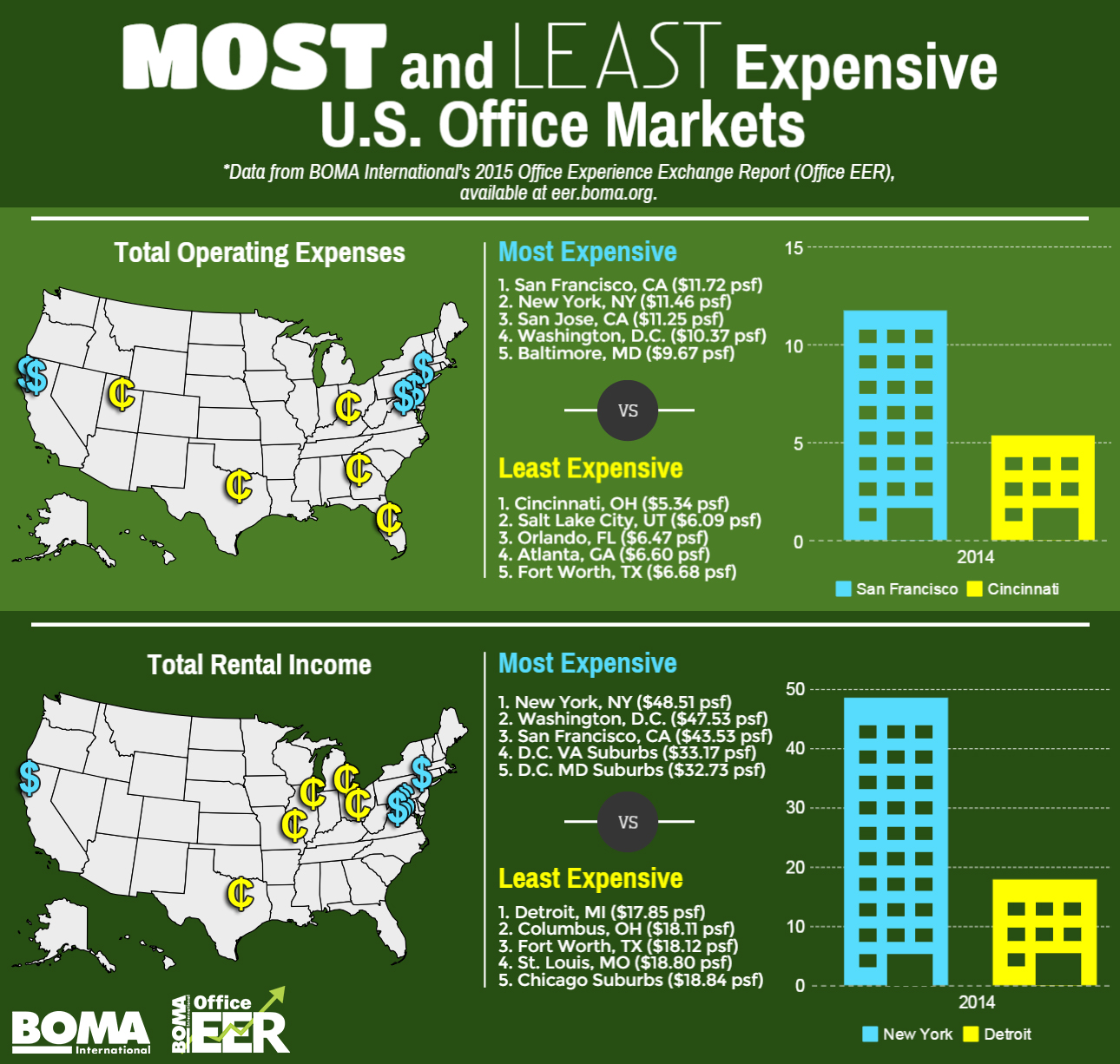

by Brianna Crandall — November 9, 2015—The Building Owners and Managers Association (BOMA) International, using the data found in its 2015 Office Experience Exchange Report (Office EER), has compiled a list of the most and least expensive office markets in the United States, both in terms of operating expenses and rental rates. The annual Office EER aggregates office sector income and expense data from the previous year; 2014 data was gathered from more than 5,300 buildings in 275 markets in the United States and Canada representing more than 820 million square feet.

The report covers operating expenses and rental rates from more than 5,300 buildings in 275 markets in the USA and Canada. Click image to enlarge.

Total operating expenses

Total operating expenses incorporate all expenses incurred to operate office buildings, including utilities, repairs and maintenance, roads and grounds, cleaning, administration and security. Overall operating expenses increased in 2014, possibly as a result of the continuing trend towards densification.

Baltimore is new to the list of most expensive markets for operating costs, while the other four markets have appeared in the top five for two years running. San Francisco bumped New York from the top of the list with average total operating expenses of $11.72 per square foot (psf), up significantly from $10.09 psf in 2013. At the other end of the spectrum, Cincinnati, at $5.34 psf, replaced Raleigh, North Carolina, in 2014 as the market with the lowest reported operating expenses.

Five Most Expensive Markets – Total Operating Expenses:

- San Francisco, California — $11.72 per square foot (psf)

- New York, New York — $11.46 psf

- San Jose, California — $11.25 psf

- Washington, DC — $10.37 psf

- Baltimore, Maryland — $9.67 psf

Five Least Expensive Markets – Total Operating Expenses:

- Cincinnati, Ohio — $5.34 per square foot (psf)

- Salt Lake City, Utah — $6.09 psf

- Orlando, Florida — $6.47 psf

- Atlanta, Georgia — $6.60 psf

- Fort Worth, Texas — $6.68 psf

Total rental income

Total rental income includes rental income from office, retail and other space, such as storage areas. Overall rental income increased in 2014, suggesting that the commercial real estate industry has finally emerged from the “Great Recession.” The gap between the most expensive and least expensive markets narrowed in 2014.

Nonetheless, with an average total rental income per square foot of $48.51, New York was nearly three times as expensive as Detroit, which came in at $17.85 psf. The Washington, DC, metro area dominated the top five markets for 2014; though at $47.53 psf, the District of Columbia was still significantly more expensive than its Virginia and Maryland suburbs, which saw average rental incomes of $33.17 psf and $32.73 psf, respectively.

Five Most Expensive Markets – Total Rental Income:

- New York, New York — $48.51 per square foot (psf)

- Washington, DC — $47.53 psf

- San Francisco, California — $43.53 psf

- Washington, DC’s Virginia Suburbs — $33.17 psf

- Washington, DC’s Maryland Suburbs — $32.73 psf

Five Least Expensive Markets – Total Rental Income:

- Detroit, Michigan — $17.85 per square foot (psf)

- Columbus, Ohio — $18.11 psf

- Fort Worth, Texas — $18.12 psf

- St. Louis, Missouri — $18.80 psf

- Chicago, Illinois Suburbs — $18.84 psf

The Office EER provides critical insight into the performance of the office sector. With extensive historical information, the Office EER allows users to conduct multi-year analysis of single markets, as well as generate customized reports based on various building characteristics and property types such as medical office buildings, corporate facilities and government buildings.

This year, BOMA International also announced the launch of the inaugural Industrial Experience Exchange Report (Industrial EER), a benchmarking resource for the commercial real estate industry specifically tailored to the industrial sector. For more information and to subscribe to the 2015 Office EER and first-ever Industrial EER, visit the BOMA EER Web page.