by Brianna Crandall — October 23, 2015—Despite increased stock market volatility, the uncertainty of events in China and the Middle East, and the approaching return of U.S. monetary tightening, real estate investors have delivered another robust year of rising volumes and values, according to annual research published recently by international real estate services firm Cushman & Wakefield (C&W).

Despite global challenges, real estate investors have delivered another robust year of rising volumes and values.

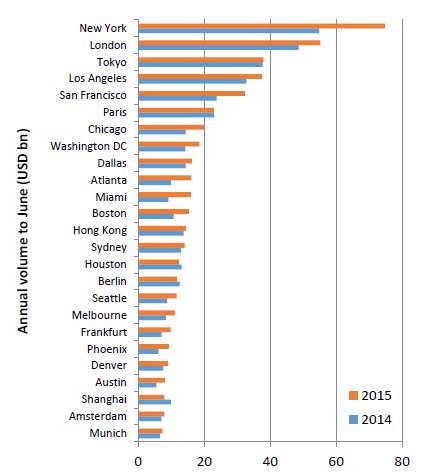

The Winning in Growth Cities report — an annual survey of global commercial real estate investment activity that lists the most successful cities in attracting capital — launched at the Expo Real in Munich. The report shows that global property investment rose 16% in the year to June (U.S.$942.8 billion) and now stands at its highest since 2008, just 13% below the pre-crisis peak.

However, the report also reveals that below the strong global performance, the market is far from uniform, with results varying across regions and apparently established capital flows starting to change. Risk tolerances that have steadily loosened as the global economic recovery has taken hold over the past two years have reverted to type in the face of increased uncertainty in parts of the world.

This has resulted in a stronger flow back towards the most liquid and accessible markets. The report shows that the top 25 gateway cities in terms of real estate investment saw their market share rise from 51% to 53%.

In the number one spot, New York increased its market share, driven by foreign buying in particular. London was again the second largest market overall but top for foreign buyers, while Tokyo, Los Angeles and San Francisco made up the rest of the top five – unchanged from last year.

Top Cities for Investment (ex Development)

The top 25 gateway cities in terms of real estate investment saw their market share rise from 51% to 53%.

Report author David Hutchings, head of EMEA Investment Strategy, Cushman & Wakefield, explained, “Despite the strong overall growth and the major gateway cities remaining largely unmoved, change is more evident at regional levels.

“Europe is still a magnet for capital from all regions, but North America has actually been the fastest growing target for foreign capital — a fact reflected in the dominance of U.S. cities in this year’s report. Fourteen of the top 25 cities are in the USA, while Germany, the second most popular country by number, has just three cities making the list. Investment into these U.S. cities grew by 32% compared to just 7% growth for non-U.S. cities in the top 25.

“Outward investment by U.S. players is also dominating global capital flows, accounting for 42% of all foreign investment between regions in the past year and growing by 25%. Asian investment globally comes in at number two, with a 25% market share, as investors’ search for greater global diversification has, if anything, been accelerated by fears of a regional slowdown, but has also become more focused, with the U.S. a notable winner.”

The report also identifies the winning cities for 2016 and states that, while major geopolitical factors remain in play, local market conditions should be of greater note, with a number of cities set to deliver steady rental growth thanks to constrained pipelines and firming demand–perhaps not the best news for end-users, but indicative of a growing economy.

Core gateway markets such as London, Berlin, Paris, Sydney, Tokyo, Shanghai, Seoul, New York, Boston and San Francisco offer potential — albeit with more risk-taking needed to boost returns. Among Tier 2 markets, cities in Germany, the U.K., the USA and Japan will be a focus along with cities such as Madrid, Milan, Brussels, Austin and Raleigh-Durham, or looking for higher risk in markets such as Manila, Bengaluru, Mexico or Central and Eastern Europe.

Carlo Barel di Sant’Albano, CEO, Global Capital Markets, Cushman & Wakefield, added:

Looking ahead, while increased global uncertainty will continue to affect investors, corporate confidence is still generally high and, allied to the changes in demand being wrought by new living and working practices, this underpins a fundamentally robust outlook for good quality real estate. Our current forecast is for global volumes to rise 17% over the year to mid-2016, reaching a new record high of $1.1 trillion — excluding development — led again by growth in Europe and North America.

The Winning in Growth Cities report is available for free download from the C&W Web site.