by Brianna Crandall — February 3, 2014—Information and analytics provider IHS and its IMS Research division have released three reports in recent weeks concerning the growing global solar power industry.

The World Market for Concentrated Photovoltaics (CPV) 2013 Edition

According to this report, after years of slow progress, the global market for concentrated photovoltaic (CPV) systems is entering a phase of explosive growth, with worldwide installations set to boom by 750% from 2013 to the end of 2020. CPV installations are projected to rise to 1,362 megawatts in 2020, up from 160 megawatts in 2013, and installations will expand at double-digit percentages every year through 2020.

Worldwide installations of concentrated photovoltaic (CPV) systems are set to boom by 750% from 2013 to the end of 2020.

(Click on image to enlarge)

CPV technology employs lenses or mirrors to focus sunlight onto solar cells, explains IHS. But while this allows for more efficient PV energy generation, the use of additional optics for focusing sunlight has also driven up the cost of CPV compared to conventional PV installations, limiting the acceptance of concentrated solar solutions. However, the situation is changing rapidly as advancements in CPV technology reduce costs.

Predictions for the Solar Industry in 2014—Top 10 Trends for the Year Ahead

This white paper issued by the IHS Solar service covers the top predictions for the global photovoltaic (PV) market in 2014:

- Double-digit growth yet again in 2014 as PV installations top 40 GW

- PV energy storage moves beyond hype in 2014

- PV module ASP declines to keep margins slim in 2014

- 2014 to trigger technology upgrades and return of capital spending

- Latin America to install more than 1 GW of PV capacity in 2014

- U.S. net-energy metering debate continues in 2014

- Asian PV inverter suppliers to advance in 2014

- China unlikely to reach ambitious distributed solar target in 2014

- PV module prices will continue to decline over the long term

- Unsubsidized PV market to take off in 2014

“After two years of a punishing downturn, the global solar industry is on the rebound,” said Ash Sharma, senior research director for solar at IHS. “Worldwide PV installations are set to rise by double digits in 2014, solar manufacturing capital spending is recovering, module prices are stabilizing and emerging markets are on the rise. However, challenges remain, including changes in government incentives and policy, an ongoing backlash to the rapid rise of renewables, and razor-thin margins throughout the solar value chain.”

Although some U.S. states are re-evaluating their net-energy metering (NEM) incentives, IHS expects the impact of any potential changes on the U.S. photovoltaics (PV) industry to be negligible in 2014

(Click on image to enlarge)

U.S. Debates Rolling Back Net Energy Metering PV Perspectives Market Brief – Issue 8 – 2013

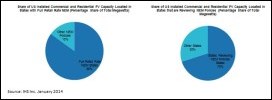

Despite efforts from some U.S. states to re-evaluate their net-energy metering (NEM) incentives, which IHS sees as critical to supporting the customer-sited PV market, the group expects the impact of any potential changes on the U.S. PV industry to be negligible in 2014. IHS estimates that 85% of distributed solar PV capacity installed to date in the United States is located in states with full retail-rate NEM, while an estimated 70% is located in states that are reviewing their NEM policies.

NEM programs typically credit utility customers with solar PV systems at the full retail rate for the power they produce, explains IHS. Effectively, customers are able to roll back their utility bills with the credits from those they have earned for PV generation. NEM customers pay only for the net amount of electricity used, after subtracting the PV generation from their bills, which could potentially trigger a payment from the utility.

The debate in Arizona, Colorado and California has focused on determining the value of NEM PV power to non-NEM ratepayers and how to recover the difference, if any, between the retail rate and this value.