by Shane Henson — June 26, 2013—Japan’s solar installations surged by a stunning 270 percent in gigawatts (GW) in the first quarter of 2013, positioning the country to surpass Germany to become the world’s largest photovoltaics (PV) market in terms of revenue this year, according to IHS Inc.’s report, The Photovoltaic Market in Japan.

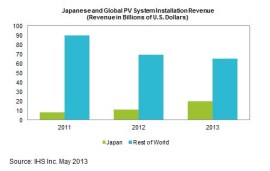

A total of 1.5 gigawatts (GW) worth of PV systems were installed in Japan in the first quarter of 2013, up from 0.4 GW during the same time last year, according to the report. The phenomenal growth that started the year is expected to continue throughout 2013 as demand for solar energy is forecast to double, making Japan the world’s largest market for PV installations on a revenue basis for the first time in a decade. Japan’s share of global PV system revenue will rise to 24 percent in 2013, up from 14 percent in 2012 and just 9 percent in 2011, says IHS.

“Following the earthquake and tsunami in 2011 that led to the shutdown of nuclear facilities and a shortage of electricity, Japan has aggressively moved to promote solar energy,” explains Sam Wilkinson, solar research manager at IHS. “Japan’s government has introduced a highly attractive feed-in tariff (FIT) to help stimulate solar growth. In contrast, the European market that historically has led global solar demand is slowing as regional market conditions become less attractive. The deceleration in Europe and the implementation of the FIT in Japan are combining to propel the country to the top of the global solar market this year.”

In contrast to solid expansion in Japan, installations in Europe declined by 34 percent year-on-year in the first quarter. Europe previously had been the main focus of almost all PV suppliers and had provided the lion’s share of global demand. But in the first quarter of 2013, Europe accounted for 40 percent of global demand, down from 70 percent just one year before, and its share is forecast to continue falling throughout 2013.

As European markets become less and less attractive, suppliers are seeking greener pastures elsewhere, says IHS. “Continued reductions in feed-in tariff rates and incentives, combined with the introduction of antidumping import tariffs, have resulted in many of the largest suppliers switching their focus to new opportunities,” Wilkinson said.

However, the PV market in Japan is not without challenge, notes IHS. While huge growth opportunities exist in the country, capitalizing on them is not a straightforward task for international suppliers. Strict certification requirements, particularly for inverters, make it difficult for suppliers to release products. Furthermore, a strong preference for Japanese brands—particularly in the residential market, which will account for nearly 40 percent of demand in 2013—means that forging partnerships with local suppliers is essential.

“Although international suppliers have only been able to win limited business in the residential sector, mostly by supplying local suppliers through agreements with original equipment manufacturers, the situation for larger systems is quite different,” Wilkinson said. “The fastest-growing market segment is forecast to be systems larger than 1 megawatt, which is expected to grow by more than 500 percent in 2013. International PV module suppliers have been more successful in partnering with local project developers and have been able to ship large volumes to Japan to serve this market.”