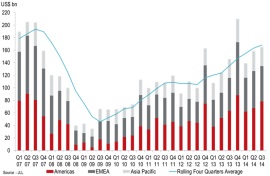

by Brianna Crandall — October 13, 2014—Increasing allocation levels to direct real estate have helped push third-quarter (Q3) 2014 global real estate investment volumes to US$165 billion, 4% higher than Q2 2014 and 13% higher than Q3 2013, according to a report from global commercial real estate services firm JLL (Jones Lang LaSalle). This has taken global 2014 year-to-date (YTD) volumes to $463 billion, 23% higher than the $378 billion recorded in the first three quarters of 2013.

“Global commercial property markets continue to see increased investor activity with both prime and secondary opportunities attracting substantial competition and interest from clients,” said Arthur de Haast, lead director, International Capital Group at JLL. “The sheer amount of equity still on the sidelines awaiting deployment means total volumes this year are on track to reach US$700 billion, an amount we last saw back in 2006.”

JLL’s analysis of current global commercial property markets follows.

The Americas

Strong growth was recorded in the United States, Brazil and Mexico, with Q3 2014 volumes totaling $78 billion, 16% higher than Q2 2014 and 23% higher than Q3 2014. 2014 YTD volumes are $207 billion, up 35% on a year-on-year basis.

Europe

European volumes for Q3 2014 reached $56 billion, a 5% decline on Q2 2014 but still 7% higher than Q3 2013. 2014 YTD volumes are buoyant at $170 billion, 26% higher in terms of U.S. dollars and 22% higher in euro terms. Strong performance in core markets of France, Germany and the U.K. are being supported by increasing activity levels in more peripheral markets of Central and Eastern Europe (up 35%), Benelux (up 56%), the Nordics (up 20%) and Southern Europe (up 72%).

Asia Pacific

Asia-Pacific investment markets were stable in Q3 2014, with volumes of $31 billion. Although this amount is down 3% on Q2 2014, it is 3% higher than Q3 2013, meaning the gap between 2013 and 2014 levels have narrowed, with 2013 YTD volumes of $86 billion only 4% behind last year. While Australia and Japan transactional markets have grown, YTD 2014 volumes in China are down 30% compared to 2013, although this decline is temporary as global investor demand for Chinese real estate remains substantial.

David Green-Morgan, Global Capital Markets research director at JLL, added, “The turnaround in occupier demand in 2014 continues to give investment markets a supporting tailwind. The below-average development pipeline of the last few years means that rents are rising significantly in locations where demand is strong. This provides investors with confidence that their assets will perform well, which encourages them to invest in additional opportunities.”