by Brianna Crandall — March 28, 2016—Growing online sales will not deter retailers’ physical store expansion plans in 2016, reports global real estate advisor CBRE in its seventh edition of How Active Are Retailers Globally?, a study of over a 150 major international brands based in the Americas, Asia Pacific, and Europe, Middle East and Africa (EMEA).

The survey findings show that 83% of brands suggest their physical store expansion plans will not be affected by the growth in e-commerce in 2016, although this is likely to vary from market to market, and only 22% of the brands are concerned about stiff competition from online retailing. Out of those questioned, 17% have large-scale ambitions, with many retailers looking to open more than 40 stores (up from 9% in 2015) in 2016. The vast majority (67%) are looking to open up to 20 stores.

According to Natasha Patel, associate director, EMEA Retail Research:

Despite the backdrop of economic uncertainty and the popularity of online shopping growing year on year, a physical store presence in key locations is still critical to the strength of a brand’s presence. Stores still need to create an emotional affinity with a shopper, and customers still feel a need to go into store, physically touch a product, and enjoy the feel-good factor associated with a particular brand experience. The store is integral to the shopping journey and can be used in a number of different ways, such as to click and collect, research of the product or brand, or to test the product. It isn’t solely about the transactional side.

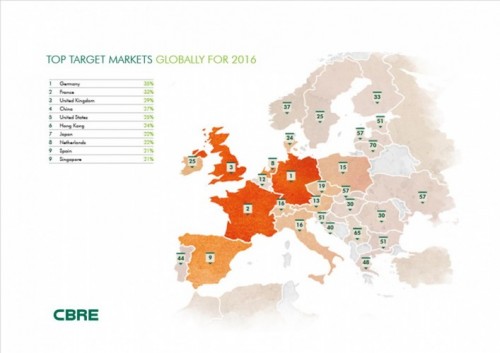

According to the report, core Western Europe is at the top of retailers’ expansion targets, with Germany proving most popular with 35% of retailers looking to expand there, France with 33%, and the U.K. at 29%.

China is said to be the top Asian market, with 27% of retailers looking to expand there, and a quarter of retailers are looking to the United States as a retail destination in 2016.

Mark Burlton, global executive, Retail Occupier team, EMEA, commented:

Retailers continue to find confidence in the tried and tested retail strongholds of Europe. All three countries are home to cities with good consumer spending power and steady levels of tourism. Germany offers retailers the opportunity to target six key cities, all with large populations and significant purchasing power, while France and the U.K. are two of the major global fashion capitals, where a retail presence alone guarantees significant brand exposure. European brands still see significant potential within their own regions and are as such still focusing their expansion ambitions within their own borders.

Despite the positive headlines, retailers are remaining “cautiously optimistic” in 2016. When questioned about the risk factors for them in in the coming year, similar to last year, real estate cost escalation (56%) and unclear economic prospects (42%) continue to be at the forefront of their minds.

Street shops (76%) and regional shopping malls (72%) were cited as the most popular formats for expansion, with an increasing number of brands looking to travel hubs. A fifth of brands, largely from the Americas and EMEA, stated their intention to expand into travel hubs in 2016, as this will give them access to high-footfall, highly frequented locations.

Burlton concluded, “The challenge now is for retailers to build an engaging offer that encourages people to stay longer and spend more.”

The full report, How Active Are Retailers Globally?, is available from the CBRE Research and Reports page for download with log-in.