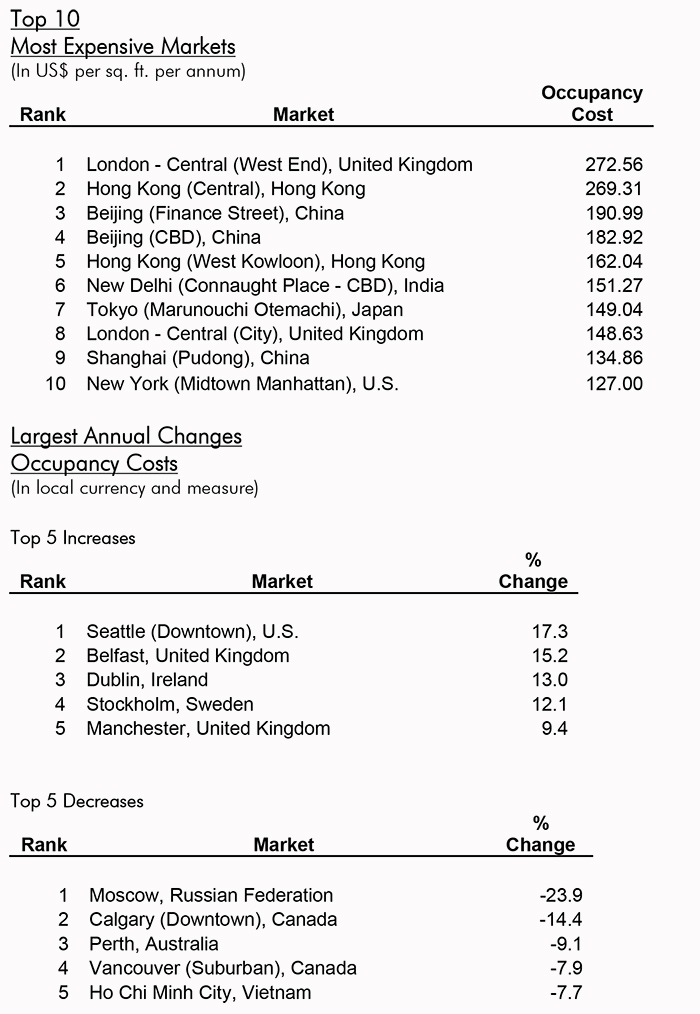

by Brianna Crandall — January 22, 2016—London’s West End was the world’s highest-priced office market for the second straight year, and Hong Kong (Central), Beijing (Finance Street), Beijing (Central Business District) and Hong Kong (West Kowloon) took four of the top five most expensive spots in the rankings, according to CBRE Research’s semi-annual Global Prime Office Occupancy Costs survey.

For those who wonder how their seemingly high occupancy costs compare to those around the world, London’s West End topped the “most expensive” list, with overall prime office occupancy costs of U.S.$273 per square foot per year. Hong Kong (Central) followed, with prime occupancy costs of $269 per square foot. Beijing (Finance Street), at $191 per sq. ft., Beijing (Central Business District CBD), at $183 per sq. ft., and Hong Kong (West Kowloon), at $162 per sq. ft., rounded out the top five.

Prime occupancy costs — which reflect rent, plus local taxes and service charges — increased at a 2.4 percent annual pace globally, as the world economy continued to gradually improve and the service sector, a key bellwether for prime office space, entered its fourth year of expansion, driving healthy demand for space in top-quality properties.

In the Americas, prime office occupancy costs increased by 3.1 percent year-over-year, largely thanks to the United States, where rising office-using employment growth stimulated demand for commercial real estate nationwide, including in some key non-gateway and suburban markets.

Prime occupancy costs in Europe, the Middle East & Africa (EMEA) rose 2.2% following economic recovery, while costs in Asia Pacific increased by 1.9%.

Richard Barkham, global chief economist, CBRE, commented:

The global services sector has grown steadily for four years now, which helps to explain the general uplift in office rents and costs we are seeing worldwide. Despite the fact that some markets have been hit by the China, oil and commodities slowdowns, we expect that most advanced economies will keep growing in 2016 and 2017, which combined with limited availability and relatively muted development levels, will result in moderate 2% to 3% cost increases.

CBRE tracks occupancy costs for prime office space in 126 markets around the globe. Of the top 50 “most expensive” markets, 19 were in EMEA, 20 were in Asia Pacific, and 11 were in the Americas. CBRE’s analysis of each region appears below.

The Americas

New York (Midtown) retained its spot in 10th place and remained the most expensive Americas market, with a prime office occupancy cost of $127 per sq. ft.

Tech-focused markets continued to fare well, with Seattle (Downtown) topping the global list of increases in occupancy costs, up 17.3% year-over-year, and prime costs continuing to rise in San Francisco despite an increase in the supply of Class A product.

Prime occupancy costs grew in a host of key cities and suburban markets, including Washington, D.C. (Downtown), San Francisco (Peninsula), Seattle (Downtown), Seattle (Suburban), Atlanta (Downtown) and Atlanta (Suburban) — evidencing the growing breadth and depth of the recovery of the office market in the USA.

In Latin America, Lima, Monterrey, Buenos Aires and Mexico City rose up the ranks, showing that the troubles being felt by Brazil are not typical of the whole region.

Europe, Middle East and Africa (EMEA)

A full 33 markets in EMEA notched increases in occupancy costs as the region’s economic recovery continued to take hold, with 65% of European markets moving up by more than three places in the rankings.

Four of the rising markets — Prague, Warsaw, Bucharest and Belgrade — were in Central Europe, which has performed better because of the pick-up in the Eurozone and the benefits it offers in terms of a low-cost location for manufacturing and service sector activity.

Office rent values also significantly increased in several U.K. regional cities, including Manchester, Leeds, Liverpool, Southampton and Belfast, providing evidence of an increasingly positive supply-demand balance for U.K. markets outside London.

Asia Pacific

Asia Pacific is home to seven of the top 10 most expensive markets globally: Hong Kong (Central), Beijing (Finance Street), Beijing (CBD), Hong Kong (West Kowloon), New Delhi (Connaught Place – CBD), Tokyo (Marunouchi Otemachi) and Shanghai (Pudong).

Shanghai (Pudong) moved into the top 10 globally, rising two places to the ninth spot. Despite the Chinese economic slowdown, demand from financial services firms for prime space in Pudong remains strong and supply remains limited.

Hong Kong (Central) remained the only market in the world — other than London’s West End — with a prime occupancy cost exceeding $200 per sq. ft. However, there is some evidence that overseas financial services companies are resistant to continued high costs and may be seeking alternatives to a Hong Kong location.