by Brianna Crandall — March 23, 2016—The first quarter (Q1) 2016 of commercial real estate development association NAIOP’s Industrial Space Demand Forecast was recently released by the NAIOP Research Foundation.

According to the report, 2016 has opened with increasing levels of global uncertainty, which have resulted in strong declines in domestic equities markets and near-term record low energy prices. These forces are expected to translate into reduced gross domestic product (GDP) and employment growth in the short term. This has stoked renewed fears of a recession in the United States, including a potential downturn in real estate markets.

Over the long term, the stimulus effect of lower energy prices on consumers and goods producers could lead to enhanced growth, but this effect will take time to be realized. The net impact, according to Dr. Hany Guirguis, Manhattan College, and Dr. Joshua Harris, University of Central Florida, therefore is lower levels of forecasted net industrial demand in 2016 and 2017.

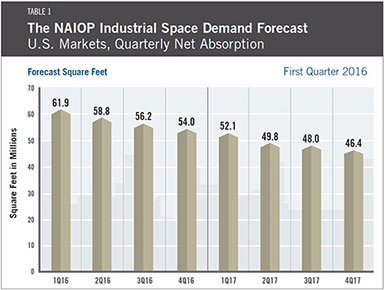

The forecast remains positive but trends lower, to quarterly rates of around 54 million square feet by the end of 2016, dropping to roughly 48 million square feet by mid-2017. This is down from the high of more than 60 million square feet absorbed on a quarterly basis last year.

While a reduction in growth rates seems inevitable, especially given the preliminary 0.7 percent annualized growth rate in fourth-quarter GDP recently reported, it is not a necessary certainty that the USA will enter a true recession. The consumer sector remains strong as unemployment sat at a relatively low rate of 4.9 percent in January and consumer confidence continues to rise.

Thus, the most likely impacts on industrial real estate markets will be significant slowdowns in the growth rate in markets dominated by energy producers and export-focused manufacturers. Industrial markets focused on domestic production and distribution to consumers will continue to experience relatively moderate, healthy growth.

Dr. Harris comments:

On the upside, interest rates and inflation are highly likely to remain low in 2016 and even 2017, boosting the asset markets. Income-producing real estate, including industrial properties, is likely to remain favored by global investors seeking yield. This means that the direct risk of an asset pricing bubble in real estate is unlikely, and any such risk should emanate from declines in the fundamental space markets.

New supply therefore should be added cautiously, based on local market conditions. The risks of further global market contagion affecting domestic demand cannot be understated. Still, when compared to issues of the past several years — the European debt crisis, for example — today’s risks seem relatively less worrisome.

Guirguis and Harris offer a concluding note:

The estimates of national net absorption of industrial real estate presented herein are based, in part, on forecasts of macroeconomic activity in the U.S. As such, when predictions of macroeconomic activity become more variable and risky, as they have over the past three months, so do forecasts of real estate demand that utilize such predictions as inputs.

The two variables whose forecasts have increased in variability the most are GDP and unemployment. It is these core macroeconomic indicators that are putting the most downward pressure on the forecast. If these indicators resume faster growth rates and greater stability, it is possible that net absorption of industrial space could climb above the currently forecast levels.

The predictive model is funded by the NAIOP Research Foundation and was developed by Guirguis and Dr. Randy Anderson, formerly of the University of Central Florida. The quarterly Industrial Space Demand Forecast report is available to download from the NAIOP Web site.